Diop to the Antananarivo’s university students

http://www.worldbank.org/en/news/speech/2014/05/16/lafrique-innove-celebrer-les-reussites-relever-les-defis

Africa Innovate: Celebrating Successes and Addressing Challenges

May 16, 2014

As Prepared for Delivery

I am pleased to be here at the University of Antananarivo. The University and the World Bank have a longstanding partnership and I am delighted to contribute to this partnership through my presence here today.

The topic I would like to address is Africa’s innovation and self-transformation process. As your country emerges from a period of crisis, I hope that you will draw inspiration from other African countries that have experienced crises but have also demonstrated, over the past 10 years, that it is possible to change their destiny.

I would also like to both celebrate our successes and acknowledge our challenges, and my remarks today will strike this balance. Great success has been achieved in recent years, which we must celebrate. Understanding the drivers of this success will also help us understand the challenges so that we may better address them.

“Recent Successes”

As we all know, Africa’s economies are enjoying a period of unprecedented growth and development. Sub-Saharan Africa, excluding South Africa, grew by more than 6 percent in 2013 (6.1 percent), consolidating more than a decade of growth rates above 5 percent, even taking into account the slight drop in 2009 because of the global crisis.

Growth on the continent reflects an important structural trend in African economies. Nigeria recently revised its GDP, which now stands at more than US$500 billion, surpassing South Africa and becoming the biggest economy in Africa. Other African countries such as Ghana and Kenya have also improved their GDP statistics. Other countries will follow suit.

These revised figures shed light not only on the size of these economies, but also on their composition. First, services are now a key pillar of the African economy and the extractive industries and agriculture continue to be one of the strongest drivers. However, the role to be played by the manufacturing sector over the next 10 years is still a matter of debate.

While the share of the manufacturing sector in overall GDP has increased in some countries such as Nigeria and Ethiopia, it is clearly declining in most other countries. The role of the manufacturing sector in the development of Africa’s economies is being debated and views on this topic abound. This has been addressed by economists such as Haussman, Velasco, my colleague Bill Maloney or, more recently, the African Center for Economic Transformation think tank headed by African economists, whose report has just been published. Among all the views expressed, the common issue is the productivity of African economies.

For this reason, we at the World Bank have a renewed interest in higher education, particularly the role of sciences. Currently, only 25 percent of the graduates of African universities have been trained in science, technology, engineering, and math.

Second, the infrastructure deficit, particularly in the energy sector, is also an obstacle that will have to be overcome in order to boost the productivity level of African economies. Consequently, special emphasis has been placed on the infrastructure and energy sectors in World Bank programs currently being implemented in Africa.

I would like to return to the subject of the recent development of African economies. GDP growth in Sub-Saharan Africa is expected to be 5.2 percent in 2014 and 5.4 percent in 2015 and 2016. These growth rates are now the rule rather than the exception in Africa.

Why is Africa growing at these rates, when it previously struggled to perform at such a level?

We know that part of the reason is linked to trends in commodity prices.

In 2000, about half of Africa’s economies were major commodity exporters. In countries such as Angola, Chad, Equatorial Guinea, Gabon, and Nigeria, more than 92 percent of export earnings, on average, are derived from oil. And in other non-oil producing but resource-rich countries such as Botswana, Guinea, Mauritania, and Sierra Leone, 50 percent of export earnings come from natural resources. We must therefore acknowledge that Africa has benefitted, in part, from events beyond its control.

But this is only part of the story.

We have also seen improvements in governance and in macroeconomic management, the factors underlying more robust economic growth.

Budget deficits have been brought under control in most countries and impressive measures have been adopted to curb inflation. Sub-Saharan Africa is, in fact, performing better than the OECD countries. In 2013, the average debt of African governments stood at 33.9 percent, compared to a figure of 107.1 percent in developed economies. This performance has played a key role in developing confidence in African economies and attracting sizeable amounts of foreign direct investment.

Improved governance and strengthened macroeconomic management have helped make Africa a destination for foreign investors. Not just short-term flows, but direct investment that is flowing in because investors believe that African economies will continue to grow in the years ahead.

Financial uncertainty and deleveraging in the Eurozone drove down private capital flows to developing countries by about 9 percent in 2012. However, that same year, private inflows to Africa increased by more than 3 percent and reached a record high of US$55 billion. African public debt is increasingly viewed by investors as an asset class that can offer robust returns and, at the same time, risk diversification by moving away from developed country financial markets. And as governments provide greater stability, international investors are turning to the African private sector.

Foreign direct investment is expected to remain strong. FDI in Africa increased by 16 percent in 2013, climbing to US$43 billion. FDI in Africa is forecast to reach $56 billion by 2015. And while the extractive industries dominate, their importance in productive investments is declining, reflecting increasing services investments, especially in banking, transportation, telecommunications, and water.

This augurs very well for long-term confidence in Africa’s economies and has also been the third main driver of Africa’s improved performance in the last decade, along with rising commodity prices and improved economic management. Foreign savings have augmented Africa’s own, quite low, savings levels.

Domestic investment has also posted solid increases in recent years. All these factors have helped fund an investment boom in Africa. And we expect this trend to continue.

“Addressing the Challenges”

So … will this performance continue? And how can we strengthen it further?

At the World Bank, our analysis of Africa’s growth prospects points mostly to positive signs and suggests that Africa should continue to grow at about 6 percent a year, excluding South Africa, where growth prospects are unfortunately more moderate (in the 3 percent range).

Perhaps more importantly, some of the dark clouds on the horizon of the global economy—such as Eurozone fiscal concerns or the possibility of a slowdown of China’s very rapid recent growth—may not rain too much on Africa’s parade.

Why do I say this? The Bank has conducted an analysis of alternative “negative shock” scenarios modeling the world economy and Africa’s place in it using competitive general equilibrium techniques.

The impact of a credit squeeze in the Eurozone economies is estimated at 1 percent of growth in Africa. Another scenario models a sudden change of direction of Chinese investment and thus world growth and commodity prices. This could cool commodity markets and prices and although the discovery of new mining deposits may cushion this effect, it is still something for us to watch. Still, our modeling actually suggests that this transmission channel would have a somewhat less severe impact on Africa. All told, while these scenarios capture downside risk, they do not come anywhere close to spelling disaster.

Of course, Africa faces specific risks and challenges. However, a very real opportunity exists to take Africa’s economic performance to another level and create a true African transformation. Let me mention a number of African risks, and then present to you the more optimistic picture.

“Mitigating Risks”

Conflicts. Recent events in Mali have shown how quickly regional instability can affect one of our economies. Mali’s growth rate was 5.8 percent in 2010. In 2011, its country policies and institutions were rated by the Bank as significantly stronger than the regional average. Yet in January 2012, Mali fell victim to forces beyond its own control and its economy is still trying to regain its footing.

Yet the fragility of our African countries is not always reflected in violent conflict. As you are well aware, this fragility can also be seen in profound political instability. From the time of its independence, Madagascar has experienced cyclical political crises. Since the end of the 1980s, these political crises have been preceded by periods of accelerated economic growth. Based on the experience of other countries, it is clear that economic growth in and of itself does not fuel political crises. However, in the case of Madagascar, these two phenomena appear to be linked.

How can we, public and private sector actors in Africa, minimize these crisis risks that are derailing progress?

Partly by ensuring that growth is shared across population groups and regions. It cannot be appropriated by a single group. This can be achieved in particular through improved basic infrastructure, health, education, and social services in the least developed regions. In the Sahel region, for example, solutions relating to increased agricultural productivity are also being provided to help build resilience to desertification and increased climate volatility. A significant share of the World Bank’s lending portfolio seeks to promote just that, by supporting infrastructure, agriculture, and innovative service delivery models for education, health, and social safety nets.

A second approach to reducing fragility and conflict is responding quickly and effectively to the threat of conflict. The 2011 World Development Report, which focused on fragile and post-conflict situations, underscores the importance of responding promptly to restore confidence and focusing on strengthening institutions that provide citizen security, justice, and employment, with a particular focus on young people. The Bank opened a new country office in Nairobi, which seeks to adapt our development solutions to fragile and post-conflict environments, building on the analysis of the World Development Report, among others.

A second risk is related to the energy sector, Africa’s biggest infrastructure bottleneck. The energy issue must be promptly and adequately addressed to prevent it from becoming an even greater obstacle to progress on the continent than it currently is.

A recent study of a number of African countries estimated the economic cost of power outages at over 5 percent of GDP per year in all of these countries. Thirty countries in Africa experience regular power cuts. Africa has approximately 80 GW of installed generation capacity. It also has 45 GW and 15 GW of hydropower and geothermal potential, respectively, as well as significant natural gas reserves, and, for the longer term, tremendous wind and solar potential.

The challenge, therefore, is to foster and harness private investment, with a view to boosting current levels that are generating a mere 1 to 2 GW of additional capacity each year, although more than 6 to 7 GW are required.

Based on current projections, fewer than 60 percent of Africans will have electricity in their homes by 2030, while estimates of unmet investment needs stand at over US$40 billion per year. Private sector investments in Africa account for 1 percent of total investments in developing countries. This is clearly inadequate. To ensure greater investment, we need to focus on regulatory obstacles, the performance of state-owned enterprises and innovative financing, incorporating guarantees and other characteristics in order to increase private investment.

A third challenge pertains to the issues of the capacity of fiscal institutions and lack of transparency, which, if not addressed, could imperil gains made. A number of countries have experienced strong growth, 8 percent in some cases over the past decade, almost doubling the size of these economies. However, these countries have not been able to achieve poverty reduction, an even more daunting challenge in countries whose growth is dependent on commodities. Three factors should be noted:

- Transparency in the accounting of oil revenue in State and federal state budgets.

- Avoidance of boom-bust cycles exacerbated by pro-cyclical budgetary spending.

- Increase in pro-poor spending (for example, by reducing oil subsidies for the wealthiest in favor of direct transfer payments targeting the poorest).

Of course, none of these policies can be easily implemented, an undertaking that is even more difficult when they are taken together. However, as difficult as this may be, this is the way forward for many of our countries.

We must be clear about a persistent threat: some African countries could squander their natural resource wealth, thereby creating, as has happened in the past, a legacy of debt rather than of assets.

Debt relief coupled with natural resource revenues—current or future—has made a considerable number of governments in African countries more creditworthy than ever before. However, this also creates risks and the need for prudent economic management. A recent analysis conducted by the Bank revealed that eight African countries that benefited from the Heavily Indebted Poor Countries (HIPC) and Multilateral Debt Relief initiatives increased their public debt-to-GDP ratio to one-third of pre-relief levels in just four years. Others did even better. The main challenge here, therefore, is to strengthen national institutions so as to avoid the pitfalls of uncontrolled and underproductive public spending.

“The keys to a true transformation”

If Africa can mitigate the three main risks that I discussed—conflict, key infrastructure constraints, and fiscal transparency—there will be an opportunity for an even deeper transformation than we witnessed during the past 10 years. Let me tell you why I am confident this will happen.

First, we are seeing greater political accountability. There are many positive examples of democratic political transitions in Africa in recent years: the recent peaceful democratic transition in Ghana, Sierra Leone’s solid performance as well according to all international observers, and my own country Senegal. This is increasingly becoming the rule rather than the exception in Africa, and, from an economic standpoint, all the benefits have not yet been felt.

Second, Africa has yet to reap the benefits of its youth population structure and the emergence of a new and powerful middle class.

In 2015, 61 percent of Africans will be under 25, a figure that will fall to 56 percent by 2035. This is a tremendous opportunity for growth, given that these young population groups are entering their productive years. In South Asia, however, the reverse is happening—48 percent of the population will be under 25 in 2015, but this rate will fall to 39 percent by 2035, thus placing a heavier burden on young people to support an older population.

This demographic phenomenon underscores the need to ensure that young people receive not just an education but an education that is of a better quality and more suited to labor market needs than what is currently provided in the majority of our countries.

The emergence in recent years of a large middle class in many African societies is equally important, because this means that African businesses must not only export but can also produce for their burgeoning domestic markets. In other countries such as Brazil, this phenomenon has been a driver not only of growth, but also of fundamental societal transformation.

This also underscores another opportunity—the economic integration of Africa. A recent World Bank report entitled “De-fragmenting Africa” revealed the continent’s huge potential once tariff and non-tariff barriers in Africa are removed. The incidence of these barriers falls most heavily on the poor and on women, and prevents countries from taking advantage of opportunities to diversify exports away from a narrow range of primary products. Regional trade can play a key role in creating jobs that are needed for Africa’s young populations.

Conclusion

In closing, I would like to return to the issue raised at the beginning, namely the role of natural resources in Africa’s resurgence. While some may present this factor as a potential constraint, we can examine the role of natural resources in a different way. New mapping technology is now making it possible to generate a far more accurate image of underground mineral resources. Initial findings from the most recently conducted surveys suggest that we may be using a mere one-tenth of Africa’s total oil and mineral resources. In other words, today’s engine of growth may prove to be an engine of growth for decades to come.

This will also create new challenges. We must convert these resources into human capital, jobs, opportunities, and well-being for Africa’s populations.

The World Bank is therefore focusing much of its efforts on building country capacity in order to allow these countries to benefit from improved use of natural resources, negotiate with exploration companies (we have a new fund specifically for that purpose), through transparency initiatives such as EITI, and implement fair and effective social safety nets.

So if African governments continue to strengthen governance for the benefit of their people, if we can take advantage of the demographic transition to strengthen education and training programs and create jobs through economic growth, we have the prospect of a stronger Africa that can not only trade with the rest of the world, but also within the African continent. This would represent a new phase of development in Africa, new opportunities for African investors, and a true transformation of Africa.

Misaotra (Thank You).

Immagini collegate:

Rencontre Hery Rajaonarimampianina et Makhtar Diop

http://www.madagascar-tribune.com/Rencontre-Hery-Rajaonarimampianina,19937.html

Banque mondiale et Madagascar

samedi 17 mai 2014

Le président de la République, Hery Rajaonarimampianina, a reçu ce vendredi 16 mai 2014 au Palais d’État d’Ambohitsorohitra, le vice-président de la Banque Mondiale pour l’Afrique, Makhtar Diop. Les objectifs de la rencontre étaient d’identifier les priorités du pays et de voir ensuite le soutien de la Banque mondiale.

Selon le vice-président Mahktar Diop, cette visite à Madagascar est une suite logique de la visite du président malgache à Washington où il avait rencontré le président de la Banque mondiale et lui-même et où il avait fait part de sa volonté de voir le programme de la Banque mondiale s’accélérer et de s’enquérir également des ressources additionnelles mises à la disposition de Madagascar. « La Banque mondiale est prête à aider Madagascar », poursuit-il tout en laissant entendre qu’une enveloppe de 701 millions de dollars servira à financer une dizaine de projets à mettre en œuvre dans le cadre de la politique de réduction effective de la pauvreté.

Le vice-président Mahktar Diop s’est déclaré agréablement surpris devant la volonté politique manifestée par le président Hery Rajaonarimampianina de lutter contre la pauvreté, de réduire sensiblement le taux de pauvreté, d’instaurer la bonne gouvernance et de lutter contre la corruption et toutes sortes de maux qui ont été enregistrés dans le passé. Les discussions ont porté sur la suite des actions à entreprendre, concernant entre autres les travaux de Haute Intensité de Main d’œuvre (HIMO), le chômage, la nutrition, l’éducation, l’énergie… « pour pouvoir continuer notre soutien et notre appui », a indiqué le vice-président de la Banque mondiale

Immagini collegate:

mail del 16 maggio 2014

| Da: | Giovanni Colombi (giangi.colombi@gmail.com) 16-mag-2014 12.56 |

Immagini collegate:

Convocazione del Consiglio Direttivo del 16 maggio 2014

Come concordato nell’ultima riunione, venerdì 16 maggio è convocato il consiglio direttivo, alle 20.30, in sede, a Seriate, in via Roccolo 39.

Come sempre la riunione è aperta a tutti, soci e simpatizzanti.

Questo l’ordine del giorno previsto:

1- lettura e approvazione del verbale della precedente riunione

2 – accettazione eventuali nuovi soci

3 – festa dell’8 giugno. Situazione.

4 – comunicazione da Rainay per la costruzione del liceo di Tsarafidy

5 – eventuali variazioni al progetti del 2014.

6 – varie ed eventuali.

Spero di vedervi numerosi

Un caro saluto a tutti

Come concordato nell’ultima riunione, venerdì 16 maggio è convocato il consiglio direttivo, alle 20.30, in sede, a Seriate, in via Roccolo 39.

Come sempre la riunione è aperta a tutti, soci e simpatizzanti.

Questo l’ordine del giorno previsto:

1- lettura e approvazione del verbale della precedente riunione

2 – accettazione eventuali nuovi soci

3 – festa dell’8 giugno. Situazione.

4 – comunicazione da Rainay per la costruzione del liceo di Tsarafidy

5 – eventuali variazioni al progetti del 2014.

6 – varie ed eventuali.

Spero di vedervi numerosi

Un caro saluto a tutti

Elide

Immagini collegate:

Elie Rajaonarison: Ranitra

Elie Rajaonarison, (1951-2010) poeta malgascio, è stato un artista poliedrico. Si è infatti cimentato con successo anche nel campo della fotografia e del cinema. Laureato in antropologia e docente presso l’Università di Antananarivo, Rajaonarison ha pubblicato una raccolta di poesie, intitolata “Ranitra”, e tradotto in lingua malgascia il poeta francese Jacques Prevert. È stato inoltre Segretario della Cultura, e per una volta anche consigliere del precedente Presidente Marc Ravalomanana durante le violenze politiche del 2002 a seguito delle elezioni presidenziali, e che portarono alle dimissioni e al successivo esilio a Parigi dell’allora Presidente Didier Ratsiraka

Nel 2002, mentre partecipava allo Writers’ Workshop presso la University dello Iowa (Usa) insieme a poeti e scrittori di altri Paesi, esortò gli scrittori malgasci a partecipare alla vita del mondo e ad uscire dalla propria insularità.

“La maggior parte dei Paesi qui presenti [all’IWP workshop] si sforzano di tradurre le proprie opere, di integrarle nel circuito culturale del nostro tempo. La nostra situazione insulare non dovrebbe essere percepita come negativa. Al contrario. Abbiamo l’opportunità di avere allo stesso tempo il senso sia del radicamento sia del viaggio, come tutti gli isolani. L’indagine sull’identità è stata ben avviata, e deve continuare a interrogarci. Ma adesso è ora di “viaggiare”. Ora è tempo di farci vedere e di vedere verso qualche altra parte, in poche parole: è arrivato il momento di esistere! Di conquistarci un posto nella mappa letteraria del mondo. Abbiamo tutte le carte in regola per vincere questa scommessa: una letteratura ben affermata scritta nella nostra lingua nazionale che continua a produrre, una padronanza del francese di cui la nostra intellighenzia si è opportunamente appropriata, il dono naturale dei malgasci di imparare le lingue, con particolare riguardo per l’inglese, uno sviluppo della tecnologia informatica di cui la gioventù urbana fa avido uso, ma che si estenderà a breve anche a tutte le classi sociali e a tutti i gruppi religiosi. Molte risorse, molte occasioni che abbiamo ora per trasformarci traducendo le nostre opere in lingue straniere perché il Mondo ci aspetta e ha bisogno anche di noi per esistere.”

Vi proponiamo la sua poesia Ranitra, che è già in sè un gioco di parole

Ranitra, “acuto” può riferirsi a qualcosa che ferisce e può al contempo significare “intelligente”.

Ranitra intesa come radice può voler dire “prendere in giro”, come il verbo “provocare”, “irritare”.

Infine, Ranitra significa anche “amico”, in lingua merina, amico segreto come in “amante”, vary ranitra.

Più amaro è il morso della rabbia

che ti sveglia la mattina

ti tiene sveglio di notte

Più amaro è il prezzo del sudore

che tu nemmeno noti

vuoto e non aiutato da

rinsecchito e grato

!…

E’ persino più duro

non sollevarsi, schiacciato dalle proteste

non sognare, pietrificato dalla debolezza,

non rassegnarsi, di vedute ristrette.Nel buio di ogni giorno

brilla la Luce

si alza la Gioia

inonda e vince la bile-che-non-si-coprepoi si alzano i cori dei pronti

a vincere ogni giorno

a porre i propri raggi all’eredità della storia

…

Cantate o colline

come colei, la più bella

che si solleva ininterrottamente invincibile in guerra

MadagascarScritta da Elie Rajaonarison il 15 Agosto 1990, un anno e cinque giorni dopo il massacro di Iavoloh [it].

Immagini collegate:

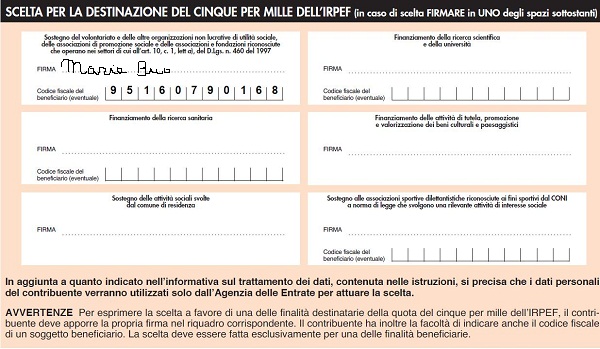

5 x 1000 2014

il tuo 5 x 1000…

Il 5 x 1000 è una quota delle tasse che paghi e che puoi destinare ad una associazione riconosciuta presso l’Agenzia delle Entrate.

UnicoSole è tra queste.

Se scegli di donare a UnicoSole il tuo 5 x 1000, quando fai la dichiarazione dei redditi devi firmare e indicare il codice fiscale dell’associazione

95160790168

nel riquadro con l’indicazione “Sostegno del volontariato e delle altre organizzazioni non lucrative di utilità sociale, delle associazioni di promozione sociale e delle associazioni e fondazioni riconosciute che operano nei settori di cui all’art. 10, c. 1, lett a), del D.Lgs. n. 460 del 1997 “

In Madagascar le scuole sono gestite dai FRAM, l’acronimo di Fikambanan’ny Ray Amandrenin’ny Mpianatra, associazioni genitori- insegnanti.

Dal momento che gli insegnanti statali sono in mumero insufficiente, i FRAM ne assumono altri a contratto, pagandoli con il riso.

I comitati si occupano anche della gestione delle mense scolastiche sostenute da UnicoSole sia impegnandosi a finanziare una parte dei costi, sia provvedendo alla preparazione del cibo.

Durante i nostri viaggi li incontriamo, ascoltiamo le loro proposte e ci confrontiamo sulle loro richieste, sulle modalità di partecipazione e di gestione delle attività.

UnicoSole utilizza tutti i fondi raccolti per il finanziamento dei progetti, perchè i soci e i sostenitori offrono gratuitamenemente la loro collaborazione.

UnicoSole utilizza tutti i fondi raccolti per il finanziamento dei progetti, perchè i soci e i sostenitori offrono gratuitamenemente la loro collaborazione.

Puoi aiutarci anche stampando il volantino del 5 x 1000 e proporre ai tuoi amici di sostenere UnicoSole.

Contiamo sul tuo impegno!

Immagini collegate:

Accelerating Land Rights Reform to Revive the Malagasy Economy

Puoi vedere il video dell’articolo cliccando il link

AMPARAFARAVOLA, April 14, 2014

Rakoto Dieudonné lives in Amparafaravola, a rural town in northeastern Madagascar. When this small farmer wanted to buy land, following the common practice, he simply signed “a piece of paper” which was authenticated by the neighborhood chief at the time. “But now,” he says, “I’m afraid that unscrupulous people will come and take my land from me. That’s why I don’t want to risk planting crops in my fields.”

Rakoto’s fears come from the fact that the little piece of paper he signed a few years ago has no legal validity. Until 2005, only an official land title issued by the State could establish property rights in Madagascar, under a system dating back to the colonial era.

“At the time, the idea was to grant property access to a limited number of entrepreneurs following a long and expensive registration process,” explains André Teyssier, a World Bank land administration specialist. To obtain this title, he added, an owner had to wait six years on average and spend around US$500, an astronomical sum considering that it amounts to two years’ income for the average Malagasy household.

As a result, of the nearly 10 million land lots identified on this Indian Ocean island, one of the poorest countries in the world, only 500,000 were registered over the last 115 years. This dysfunctional land system has hobbled Madagascar’s economic development, with farmers such as Rakoto choosing not to make the most of their land for fear of losing their property rights.

“Some twenty years ago, I began the necessary steps to obtain a land title,” says Bako Rabenandrasana, a farmer from the small town of Behenjy. “But the process was long and expensive,” she adds. “Officials from the city had to travel to my property in the country. That was an extra fee for me. And I had to go back and forth to the city to check on the process. I ended up abandoning the idea.”

Decentralizing land management

To protect the rights of Malagasy citizens to the land they own, in 2005 the government of Madagascar launched an innovative reform process that delegated responsibility for issuing land certificates to local districts. Land that was occupied but had not been registered with a State land title would no longer be considered the State’s property, but rather untitled private property that could be certified at the district level through local land offices.

One-third of the districts in the country now have these offices, and more than 100,000 land certificates have been issued since the reform process began. The certificate validates property rights through a process conducted with village elders and local authorities, without the involvement of a surveyor or land inspector, simply using a photograph of the district’s land to demarcate individuals’ lots.

“Land certificates carry the same legal weight as land titles,” Teyssier notes, “but cost US$15 each, a sum that is still too high, given that 92 percent of the people live on less than US$2 a day.”

The land reform process was significantly hampered by the political crisis that plagued the country for several years (from the takeover by a de facto government in March 2009 until new elections were held in late 2013) and prompted the withdrawal of the main donors from the country. However, in 2012, pilot operations in five districts were launched through a program conducted by the National Land Program (Programme National Foncier, PNF), with assistance from the French Agency for Development (Agence française de développement, AFD) and the World Bank.

The objective, Teyssier explains, was “to expand property rights to as many people as possible through a joint effort to reduce the cost of land certification, while boosting local tax revenue, by making a systematic survey of all the land lots in each village.” During the survey, each resident in the five districts had the option to buy a certificate at a cost of US$2 each. In seven months, more than 23,000 land certificates were issued, reflecting the interest in this simple and relatively inexpensive process.

Protecting investments

Bako Rabenandrasana is one of the village farmers who obtained a certificate through this pilot project. “Initially, I had some reservations,” she admits. “Although the [initial] cost is lower, once the certificate is issued, land taxes have to be paid. However, the local authorities explained that the taxes would not be too high. I ended up paying less than 1,000 ariary [US$0.43] a year for each lot, and the tax money will be used to rehabilitate our school.”

“We hope that the new government that took office recently will embrace this innovative approach, which has a successful track record in the pilot districts,” says Coralie Gevers, World Bank Country Manager in Madagascar. “The reform undertaken by the government should be expanded to ensure that the land rights of Malagasy farmers are protected by the State. Clear and transparent management of land rights is a prerequisite for political stability and economic recovery,” she adds.

A recent World Bank report titled “Securing Africa’s Land for Shared Prosperity” argued that land reform policies can boost agricultural productivity and transform the development prospects of African countries. In Madagascar’s case, the formalization of land rights will reduce disputes and encourage farmers to cultivate land and grow more food, thanks to the added security provided by the reforms.

Rabenandrasana’s certification has enabled her to obtain a loan from a microfinance institution, using the certificate as collateral. With the money, she plans to buy a few zebus and plant new rice fields.

Immagini collegate:

Anche per i piccoli disabili una opportunità per ricevere istruzione adeguata

Antananarivo (Agenzia Fides) –

In Madagascar sono circa 200 mila i bambini che vengono esclusi dall’istruzione scolastica perché portatori di disabilità. Nel 2008 il Governo aveva emesso un decreto per l’introduzione di un programma che prevedesse l’Inclusione dei Bambini con Disabilità. Sfortunatamente venne bloccato l’anno successivo: in seguito al colpo di stato infatti il budget per l’istruzione venne ridotto notevolmente, limitandolo ai finanziamenti dei benefattori e passando da 82 milioni di dollari nel 2008 a 14,9 milioni nel 2012. L’impossibilità del governo di soddisfare gli stipendi degli insegnanti ha imposto il pagamento delle tasse scolastiche, e le famiglie povere si sono impoverite ancora di più. Secondo il Southern Africa Regional Food Security Update di febbraio 2012, quattro quinti della popolazione del Madagascar è costretta a vivere con meno di 1 dollaro al giorno, e le famiglie povere spendono il 74% del proprio reddito per il cibo. Di conseguenza le iscrizioni scolastiche sono diminuite. Nel 2010 erano il 73,4%, rispetto all’83,3% del 2005. Nelle regioni malgasce meridionali di Atsimo Atsinanana, Melaky, Atsimo Andrefana, Androy e Anosy, il tasso di iscrizioni alla scuola elementare è inferiore al 55%. Un quarto dei piccoli malgasci, circa 1 milione, non vanno a scuola. E’ aumentato anche il numero di quelli che abbandonano gli studi, su 100 che iniziano la scuola elementare, 25 non arrivano al secondo grado, e solo 33 frequentano la scuola secondaria. Peggiore la situazione per i piccoli disabili, con un tasso di iscrizione dell’11%. I genitori di questi piccoli preferiscono non mandarli a scuola per evitargli di essere emarginati e perché sono convinti che inviare un bambino con disabilità a scuola sia una perdita di tempo e di denaro. Finalmente adesso, a tre anni di distanza, è in fase di attuazione un programma di integrazione scolastica che prevede un laboratorio per i bambini con disabilità visiva, fisica e intellettuale. Inoltre circa 400 insegnanti hanno ricevuto una formazione sull’insegnamento a questi piccoli. (AP) (2/10/2012 Agenzia Fides)